Michigan’s unemployment rate rose by half a percentage point to hit 4.1 percent in March, according to data released by Michigan’s Bureau of Labor Market Information & Strategic Initiatives. Although this equates to 65,000 fewer employed across the state, it trails the 0.9 percent spike to unemployment seen nationwide, which stood at 4.4 percent in March. The latest employment data provided by the Local Area Unemployment Statistics (LAUS), a program of the U.S. Bureau of Labor Statistics, only covers the first half of the month and provides just a glimpse of the potential impact of COVID-19 on the state’s labor market. The observed spike in unemployment over-the-month reveals the initial impact of the pandemic on the state’s labor force, predominately attributed to the first wave of pandemic-related layoffs that occurred among Hospitality and Food Service jobs in the weeks leading up to March 14th — with both industries suffering a joint loss of nearly 24,000 workers (-6.1%), accounting for nearly half of all job loss in the state. However, the majority of pandemic-related layoffs in Michigan occurred in the weeks following the period covered by this latest LAUS release, and information is not yet available to assess the full impact of the “Stay Home, Stay Safe” Executive Order on the state’s labor force.

Labor Force Trends in West Michigan

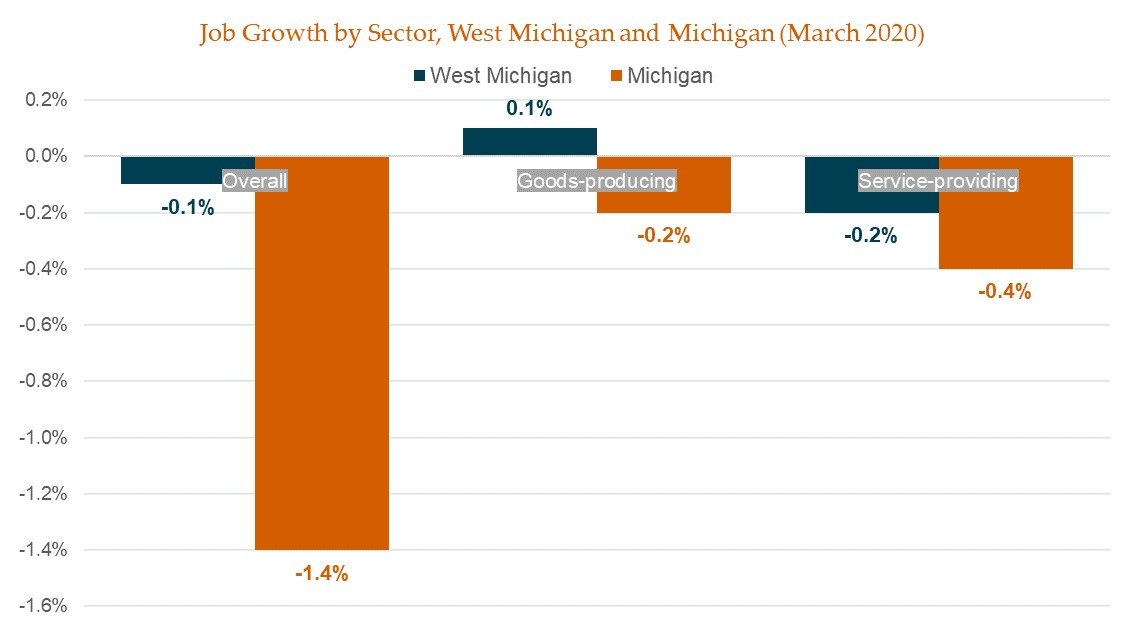

Although they may present a bleak outlook, the employment trends observed in West Michigan over-the-month fare much better than those seen statewide. In West Michigan, goods-producing industries overall gained an additional 100 jobs (+0.1%) over the first half of March while service-providing industries experienced a loss of 700 workers (-0.2%), compared to a -0.2 percent reduction for goods-producing industries statewide (-1,900 jobs) and -0.4 percent for service-providing industries (-12,700 jobs). This equates to an overall loss of 600 private-sector jobs for the 13-county region, reflecting a negative growth rate of -0.1 percent and capturing a similar trend observed in the declining number of average weekly hours worked by employees across the region.

Source: U.S. Bureau of Labor Statistics, Current Employment Statistics (CES)

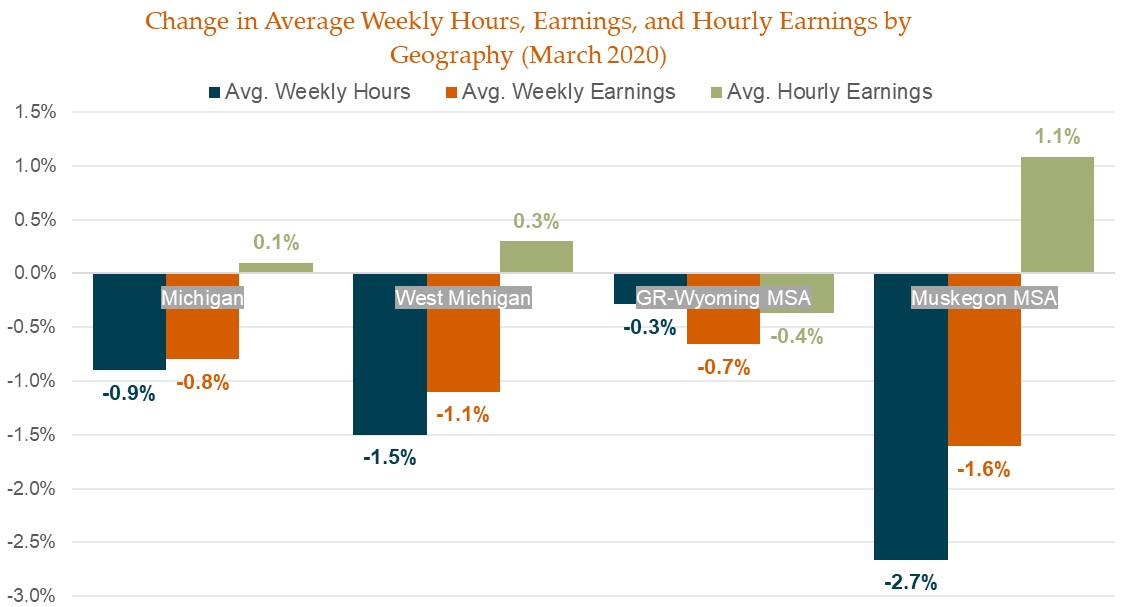

Over the first half of March West Michigan workers averaged 33.7 hours per week, which stood slightly below the statewide average of 33.9 hours per week and marks a decline of 0.5 hours per week (-1.5%) from the regional average of 34.2 hours per week recorded in February. In comparison, statewide average weekly hours fell by 0.3 hours per week, or -0.9 percent, from February into the first half of March. As average weekly hours worked across the region and state began to abate, so too did average weekly earnings. For West Michigan residents, average weekly earnings fell by -1.1 percent over-the-month to stand at $863.12 per week over the first half of March, while the statewide weekly average dropped by -0.8 percent to stand at $923.78. Yet, despite an almost $10.00 reduction to the region’s average weekly earnings over-the-month, the average hourly rate of pay increased by $0.08 (+0.3%) in West Michigan while the statewide average only increased by $0.02 (+0.1%) — potentially signaling a greater emphasis in West Michigan, when compared to the state, toward retaining high-skill or late-in-career talent through reducing the volume of comparatively lower-skilled and lower-earning non-essential employees.

Source: U.S. Bureau of Labor Statistics, Current Employment Statistics (CES)

The heavy job loss that occurred among service-providing industries in West Michigan over-the-month were primarily concentrated within the GR-Wyoming, MI MSA, which incurred a net loss of 500 jobs (-0.1%) from February to March, while goods-producing industries in the MSA gained an additional 100 jobs (+0.1%). The losses to occur within service-providing industries in the Grand Rapids MSA were predominately concentrated among just two sectors: Professional and Technical Services (-800 jobs; -3.4%) and Accommodation and Food Services (-600 jobs; -1.4%). Although Management of Companies and Enterprises also saw a significant drop to employment over-the-month, with a loss of 200 workers (-3.2%). Overall average weekly hours of workers in the MSA also dropped over-the-month to reach 34.5 hours per week in March of 2020, reflecting a loss of 0.3 percent from February (-0.1 hours per week), while overall average weekly earnings plummeted by $6.15 (-0.7%) — although average hourly earnings only fell by $0.10, to reach $26.91 in March. Still, the MSA fares better than the state, where overall average weekly hours declined by -0.9 percent over-the-month (-0.3 hours per week) and average weekly earnings fell by $7.49 (-0.8%).

In contrast, the greatest gains to employment for the MSA over-the-month were dispersed among the industries of Administrative and Waste Services (+600 jobs; +1.3%), Transportation and Warehousing (+200 jobs; +1.2%), and Retail Trade (+300 jobs; +0.6%) — closely trailed by Health Care and Social Assistance (+100 jobs; +0.1%) and Durable-goods Manufacturing (+100 jobs; +0.1%). For production workers in Retail Trade, average weekly hours increased by 0.3 percent to reach 29.6 hours per week in March of 2020, while growth to average hourly earnings in the MSA nearly tripled the rate seen statewide to hit $17.20 in March of 2020 — reflecting an additional $0.62 per hour (+3.7%) for Retail production workers.

Don’t forget to subscribe for updates.

{{cta(‘be643ac7-73e2-40f6-a7b2-7c5927924bf4’)}}