On January 21st the U.S Bureau of Labor Statistics released the latest data from its monthly Job Opening and Labor Turnover Survey (JOLTS), which contains information on employment trends, job openings, hires, separations, and layoffs for states, regions and the nation as a whole. JOLTS captures valuable information regarding the relative vitality of labor markets, and how they change over time, and is often used to guide the development of economic policy. The availability of unfilled jobs — often referred to as the job openings rate — can give researchers and policymakers a general sense of the tightness in the labor market, while the separations rate can be leveraged by employers to help benchmark retention rates across industries and geographies.

The number of unfilled jobs is considered an important measure of demand for workers. Meanwhile, for the purpose of the survey, job openings are defined as jobs that are vacant (not filled) on the last business day of each month. In order to be open, the position must meet three conditions:

- The position exists, and there is work available in that role.

- The job starts within 30 days.

- There are active recruiting efforts to find workers (outside of the organization) to fill the job.

Job Openings

The number of job openings across the nation fell by 4.8 percent in November 2021, reflecting 529,000 fewer job openings compared to the previous month. There were 15 states that saw a statistically significant decrease in job openings over the month — led by Florida (-82,000), Michigan (-67,000), and Minnesota (-66,000) — while just 3 states saw job openings grow significantly, including New York (+71,000), Connecticut (+8,000), and New Hampshire (+6,000).

There were 330,000 job openings in Michigan in November 2021, which stands 16.9 percent (-67,000) below the volume recorded the previous month — the second largest over the month drop of any state in the nation. Despite the gradual reduction in job openings seen in Michigan over the second half of 2021, the volume of opportunities for jobseekers remains nearly 55.7 percent (118,000) larger than in November 2020 and 52.7 percent (114,000) above the level seen before the pandemic in November 2019.

Unemployed Persons per Job Opening

One way to assess alignment between labor supply and labor demand is to compare the number of people looking for work (labor supply) against the number of active job openings (labor demand) in a given geography. This is commonly referred to as the ratio of unemployed persons per job opening and can be used to identify whether supply and demand are in equilibrium, or if there are other factors contributing to excess demand or supply. A ratio of 1.0 means the labor market is in equilibrium, there is a job available for every unemployed person. Lower ratios signal tighter labor markets where firms have more job openings than there are people available to work, while higher ratios indicate there are more jobseekers competing for each opening. It’s important to note that this ratio can only measure relative numbers, and does not indicate reasons for misalignment. Thus, a higher ratio could be indicative of a skills gap, meaning there are enough jobseekers to meet demand but their knowledge and skills don’t match those required of job openings. Or a higher ratio could signal that the preferences of the unemployed don’t match the compensation and benefits being offered by employers and jobseekers simply aren’t interested in those openings.

At the start of 2020, the unemployed persons per job opening ratio stood at 0.8 for both Michigan and the nation — suggesting there were just 4 jobseekers for every 5 job openings. A combination of amassing unemployment and hiring freezes caused by the pandemic and subsequent lockdown drove Michigan’s ratio to spike at 11.1 in April 2020, which was the second highest in the country after Nevada (12.6) and more than double the national ratio. By December 2020 the national ratio had declined from its 2020 peak of 5.0 down to 1.6, while Michigan’s ratio dropped to 1.8, indicating that many previously unemployed workers were either finding jobs or exiting from the labor force altogether. It’s likely that a majority of the tightening observed in the labor market over the second half of 2020 can be attributed to jobseekers no longer looking for work, as opposed to more people finding employment, as the rate of hiring didn’t begin to pick up until the first quarter of 2021.

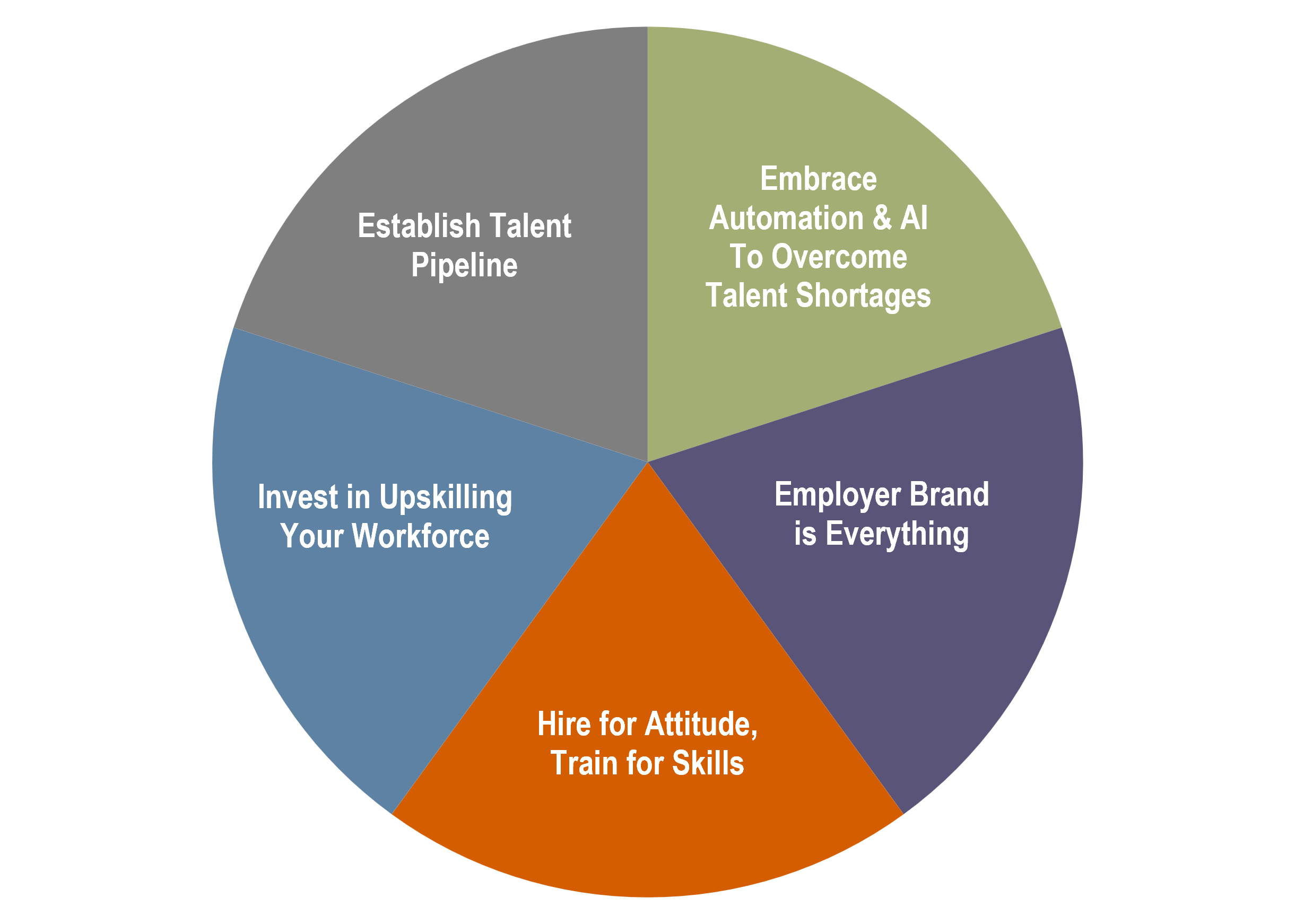

Strategies for Employers

Considering the labor market in Michigan is as tight as it was before the onset of the pandemic, with 0.8 jobseekers per opening as recently as November 2021 and record-setting rates of turnover, it’s important for employers to adopt new methods to attract and retain talent in the new talent landscape. The following strategies, with corresponding metrics and tactics, will be discussed in more detail through a series of in-person events hosted by Talent 2025, which are scheduled to begin in April. More information on these will be available soon.

{{cta(‘be643ac7-73e2-40f6-a7b2-7c5927924bf4′,’justifycenter’)}}